European, Asian Markets Plunge as Recession Fears Spread Worldwide As stock indexes plunge across Europe and Asia, Britain unveiled plans today to inject up to 50 billion pounds—close to $90 billion—into its biggest retail banks. Recent efforts to bolster world credit markets have failed to stem fears that the spreading financial crisis could lead to a global recession. We go to Rome to speak economist Loretta Napoleoni, author of Rogue Economics: Capitalism’s New Reality.

Related:

KR # 66 Global Monetary Failures mp3 Leader Shit - No Answers - Confusion - Bailing out Whom ? Failures today and failures with Enron - an example of colossal failure by design. length: 28:46 min 128 kbps stereo 26.5 MB http://kaputtradio.libsyn.com

Sydney Indymedia

Australian market plunges 5pc, dollar crashes

Australian shares closed down 5 per cent amidst global economic panic. The Australian share market plunged 5 per cent today, as the dollar hit a new five-year low. Fear of a global recession has seized markets, with big falls across the major indices overnight. The Dow Jones Industrial Average plunged 5 per cent and today the local All Ordinaries index fell by the same margin. It was down 228.1 points at 4369.8. After hitting a fresh three-year low, the ASX 200 closed 231 points lower at 4,388. CommSec's Savanth Sebastian says there are growing concerns about the ability of emerging economies to withstand the financial crisis. The fact that we saw the Indonesian market fall over 10 per cent and actually close trading for the day really had a significant impact on the rest of Asia," he said.

Australian shares closed down 5 per cent amidst global economic panic.

Associate Pofesor Steven Keen. Steven Keen has come increasingly to prominence over the past couple of years specialising in the economics of Australia's spiralling household debt burden.

PROFESSOR STEVEN KEEN: Best case scenario is a recession more severe than 1990 and lasting one and a half times as long.

Worst case is something up to the level of the Great Depression which was 20 per cent unemployment and lasting up to a decade.

$50b Aussie wipe-out

Australian stocks wiped more than $50 billion off the value of the market today after the US House of Representatives rejected a $US700 billion ($860 billion) plan to rescue the financial system.

Upwardly immobile: mortgage stress bites

Reserve Bank statistics do not begin to tell the real story of housing stress in Sydney's western suburbs, according to financial counsellor Mike Young.

Households give up three years of gains

AUSTRALIAN households have been hit so hard this year that their financial gains of the past three years have been wiped out, a Reserve Bank report has found.

Thursday, October 9, 2008

European, Asian Markets Plunge

Posted by

Community News Network

at

5:54 AM

![]()

![]()

Labels: 2008, asia, australia, britain, business-economics-and-finance, debt-crash, europe, global-recession, main-st, protest, rome, US, wall-st, world-credit, world-politics, worthless-securities

Friday, September 26, 2008

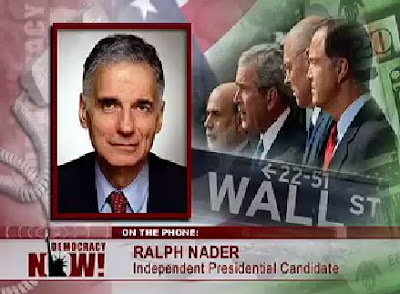

Why Is There Need for a Bailout? - Nader

As Bush Admin Pushes $700B for Wall Street, Ralph Nader Asks, "Why Is There Need for a Bailout?" As the Bush administration intensifies its pressure for Congress to quickly approve a $700 billion bailout of the financial industry, we get reaction from Independent presidential candidate and consumer advocate Ralph Nader. Nader calls Democratic claims of White House concessions “wish fulfillment” and says the bailout might not be needed in the first place.

"Cash for Trash": Unwanted "Junk" in Hand, Demonstrators Head to Wall Street to Protest Bailout

Among the more than 100 protests against the $700 bailout plan is a rally today on Wall Street. We speak to Arun Gupta, a reporter/editor at The Indypendent newspaper, whose email to friends and colleagues helped inspire the protest. Participants are planning on bringing their own personal, unwanted “junk” to illustrate what they call the federal bailout of Wall Street’s worthless securities.

Related:

Wall Street crisis: Poor to bail out the rich again “Rich people got it good in this country”, said African-American comedian Wanda Sykes on the September 24 Tonight Show with Jay Leno. “We refuse to let them not be rich. Think about it. Broke people are about to bailout rich people. This is what is going on.”

THEY WANT MAMA TO MAKE IT ALL BETTER! Rep Kaptur 'Rep. Marcy Kaptur gets it right — sort of. Wall Street and the banksters are not irresponsible, as she claims, they are criminals who methodically plotted to loot as much money as they could from the markets and then turn the corpse over to the American people, who they know will be obliged to pay for the damages.'

Bailouts Will Push US into Depression

Infowars.com 'The end result of the global economic slowdown may be the U.S. announcing national bankruptcy as the government cannot afford the bailouts that it promised and the market will not bail out the government, Martin Hennecke, senior manager of private clients at Tyche, told CNBC on Thursday.'

Flashback: Ron Paul on the Coming Economic Collapse Who is Ron Paul? What does he stand for? Ron Paul is a nine term Congressman and Presidential Candidate whose passion is monetary policy, Dr. Paul has served on The House Banking Committee and The Financial Services Committee. If anyone is in a position to know what our country has in store financially, it is this man. In this amazing interview with Michael Maloney of Goldsilver.com Presidential Candidate Ron Paul warns what lies dead ahead for our country if we continue on our present path.

Protest Against the Bush Bailout on Wall Street Take the money from the war and give it back to the poor. Yay!

KR # 64 More Debt Required mp3 plus related stuff What is money, credit, debt etc...why do we need more of it credits: excerpts of 'Money as Debt', old popular movie clips, media clips, Laurie Anderson with 'National Debt', Jon Stewart, Clarke and Daugh with 'Dubious Agency Advice', various electronica, Stewart, Clarke and Daugh with 'Dubious Agency Advice', various electronica, Sydney Indymedia.

Posted by

Community News Network

at

7:52 AM

![]()

![]()

Labels: 2008, afghanistan, barak-obama, business-economics-and-finance, debt, Iraq, john-mccain, main-st, protest, ralph-nader, US, wall-st, war, world-politics, worthless-securities